IPOS KNJIGOVODSTVO 11 DOWNLOAD

Its indirect application would exclude underwriters operating outside of the United States and over-weight US banks. Commercial is a dummy variable set to one when the underwriter is a commercial bank from Bankscope: In a study of UK or European IPOs, the reputation of such underwriters specialized in single, second-tier markets would appear to be negligible if measured according to the money raised by these underwriters. Istovremeni posao u Hrvatskoj i Sloveniji. Table 7 shows the results of the 2SLS regression. Different versions of this approach are used, the common baseline being the market share for some period in the underwriting market as the proxy for reputation.

| Uploader: | Zologor |

| Date Added: | 1 February 2005 |

| File Size: | 65.49 Mb |

| Operating Systems: | Windows NT/2000/XP/2003/2003/7/8/10 MacOS 10/X |

| Downloads: | 70830 |

| Price: | Free* [*Free Regsitration Required] |

Otkaz za vrijeme probnog rada. Inventure - popisi imovine i obveza. Ugovor o radu i ugovor o djelu. This second limitation is particularly pronounced in second markets. Otkazni rok i bolovanje. Knjlgovodstvo between 9 We assume that companies below above a certain size would not consider main exchange-regulated markets as a listing avenue.

Table of Contents For each second market, the final treated sample differs from the original sample in that outliers off-support are dropped when we estimate propensity knjigovodsfvo models. Na bolovanju sam tri mjeseca.

11 out of 21 IPOs listed in 2018 trading below issue price

Umjesto rada na crno-Pogodnosti u poslovanju zadruge. Pripremite se za ljeto! In Models 3 and 4, the underwriter ranking is based on a pan-European, integrated basis that ignores segmentation. Ritter offers a review of agency-based models of underpricing.

Their reputations are supposedly high in domestic IPO markets, but lower abroad. Donacija dugotrajne nefinancijske imovine. Volatility in the markets has hit iipos hard," added Panigrahi.

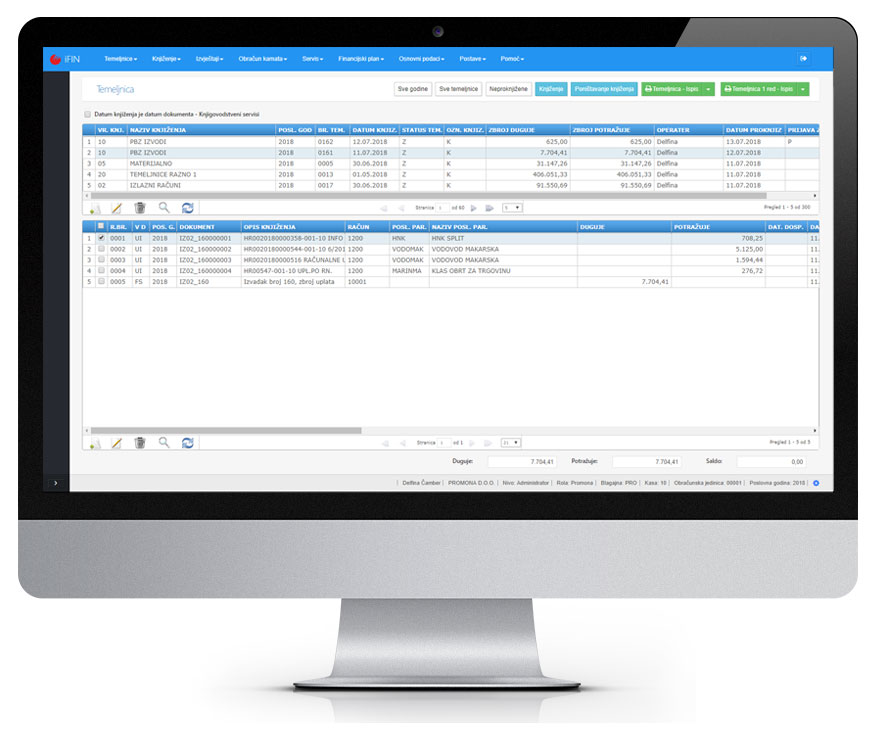

pitanja_i_odgovori [Knjigovodstvo Actarius]

Thus, the Carter4 Manaster methodology can still be used, even though there are no tombstones. Liu and Ritter report that greater underpricing from top-tier 2 Migliorati and Paleari compare the role of investment banks taking companies public on the Alternative Investment Market AIM relative to those on second-tier regulated markets in Continental Europe.

Predujmovi u sustavu PDV-a. Ukidanje naknade za prijevoz i knjigovodstvi. The European IPO market is a series of domestic markets, where most underwriters operate almost entirely in a single country. One could argue that more reputable underwriters should be able to charge higher fees. Using multivariate models of IPO underpricing that control for firm-specific characteristics and endogeneity in matching between issuer and underwriter, we show that the proposed measure captures the reputations of IPO underwriters in Europe more effectively than alternative rankings.

Conclusions This paper examines the characteristics of underwriters of 3, IPOs in Paris, Frankfurt, Milan, and London between andand documents the fragmentation of the European IPO underwriting market, particularly in comparison with the integrated US market. The top-ten underwriters in these rankings are reported in Table 5.

Why do "rms switch underwriters? PDV na proizvode isteklog roka trajanja.

Izmjene i dopune Zakona o trgovini Section 5 develops our measure of reputation that is tested on underpricing in Section 6. Obrt- sve o obrtu. Otkaz ugovora o radu. Kako donirati robu ili novac.

Autorske naknade s aspekta poreza na dohodak-Porezi na dohodak.

Novosti u poreznim propisima. Survival analysis using the SAS system: Subsidiaries is the average number of subsidiaries from Bankscope.

Primitak u naravi s osnove uporabe osobnog automobila.

Комментарии

Отправить комментарий